dekalb county tax assessor address

Quickly find Assessor phone number directions records Maysville MO. You can contact DeKalb County with general inquiries using the contact info listed below.

Dekalb County Tax Commissioner S Office

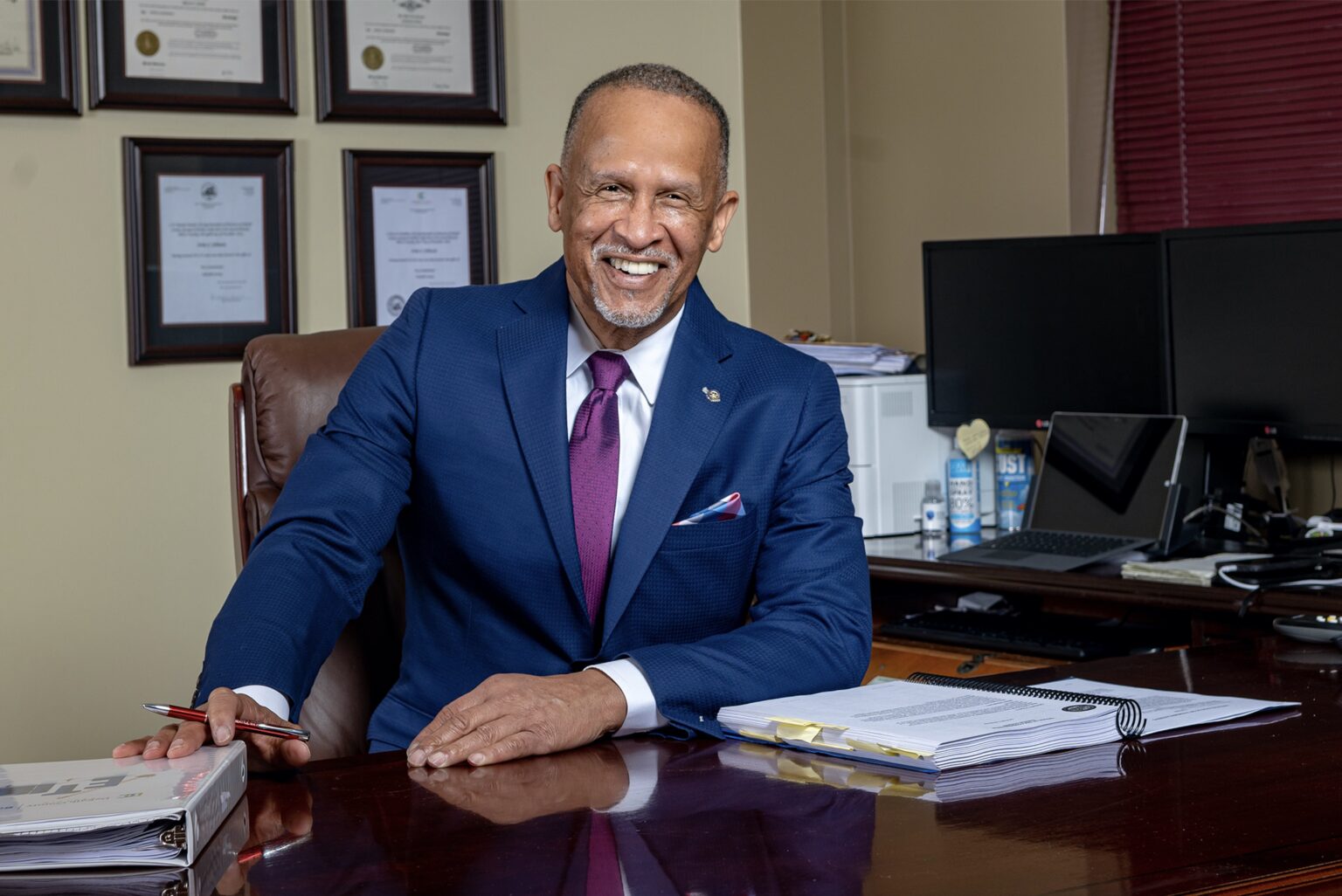

Hicks Jr Chief Appraiser 404 371-2468 404 687-7143 Fax cchicksdekalbcountygagov.

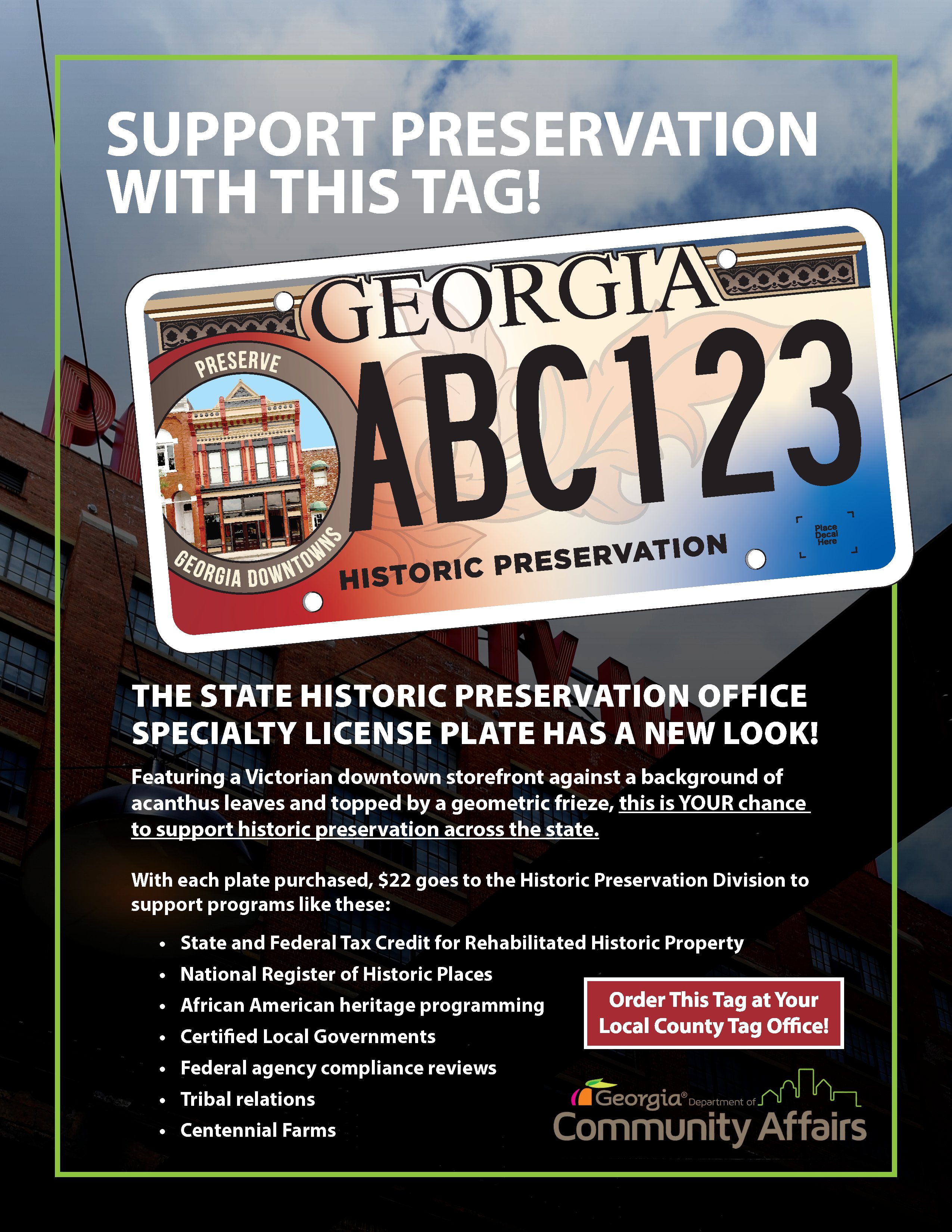

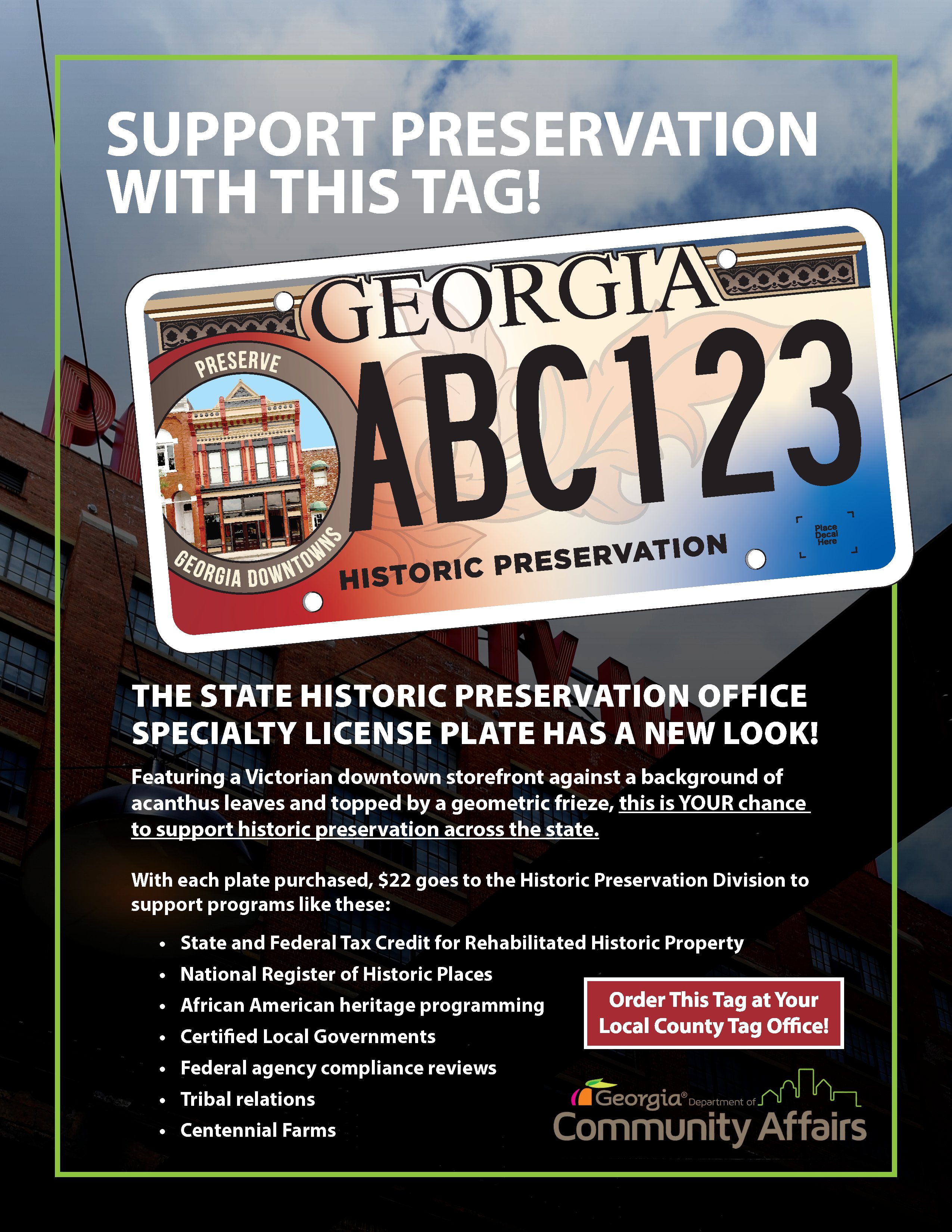

. DeKalb tag offices prepare for DOR statewide motor vehicles system upgrade Dec. Have all vehicles registered in DeKalb County and not have a homestead exemption anywhere else. Exempt Property Application and Instructions.

He is a past member of the DeKalb County. DeKalb County residents can sign up to receive Property Tax statements by email. Compass DeKalb County Online Map Search.

His practice is concentrated in the areas of real estate wills and estates. 1 day agoOn average the EHOST credit will generate a tax reduction of 1230 for qualified homes valued at 325000. The DeKalb County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within DeKalb County and may establish the amount of tax due on that property based on the fair market value appraisal.

Parcel ID PIN or Partial Parcel ID. Find DeKalb County Online Property Taxes Info From 2021. View Property Tax Information.

DeKalb County Tax Commissioner hosts ribbon cutting to commemorate new office location in Chamblee. 2019 DeKalb County. Exempt Status Update Form.

Marine Personal Property Tax Return. It has generated more than 454 million in tax relief for DeKalb property owners since 2018. Search for the property record and click the link underneath the Pay Now button.

Please contact the county Auditors Office at 260 925-2362. DeKalb Tax Commissioner. Business Personal Property Tax Return with Instruction Sheet.

Is serving as the 2022 Vice-Chair of the Board of Assessors. Staff contact information is provided for your convenience. BRIDGET NODURFT Chief County Assessment Officer.

WEdge -DeKalb County Property Tax Inquiry and Property Tax Payments. The correct return address is below. DeKalb County Property Appraisal.

The current-year EHOST tax relief is. Partial Owner Name To perform a search for property information within DeKalb County insert either one of the following. Box 100025 Decatur GA 30031-7025.

You can visit their website for more information regarding property appraisal in DeKalb County. Aircraft Personal Property Tax Return with Base Data. 1300 Commerce Drive Decatur GA 30030 404-371-2000 311CCCdekalbcountygagov.

DeKalb Tax Commissioner. Box 100004 Decatur GA 30031-7004. Application for Freeport Inventory Exemption.

All Rights Reserved Disclaimer Privacy StatementDisclaimer. Ad View Your Homes Appraisal Value Suggested Listing Price - Fast and Free. 2022 Real Estate Appeal Form.

The Property Tax Division of the Tax Commissioners Office is responsible for the billing and collecting of property taxes and the processing of Homestead Exemptions. Ad Searching Up-To-Date Property Records By County Just Got Easier. You may also contact the Property Appraisal office at 404 371-0841.

The original 2022 Personal Property Tax Return andor Freeport Application you received had the incorrect return address for the Dekalb County Property Appraisal Office. DeKalb County Assessors Office 100 South Main Street 1st Floor Courthouse Auburn IN 46706. Dekalb County Assessor Address 109 West Main Street Maysville Missouri 64469 Phone 816.

Looking for Dekalb County Assessor property tax assessments tax rates GIS. Address 123 Main Do not include St Dr Rd etc Partial Parcel ID Real Estate 12 123. DeKalb Tax Commissioner.

Decatur GA 30030. Download the Homestead Exemption Information sheet or select Exemptions under Property Tax from the Services menu. For tax information please contact the county Treasurers Office at 260 925-2712 and for exemption information.

DeKalb County Revenue Commissioner Heath Crowe 2022-07-28T094052-0600. DeKalb County Sheriffs Office. In 2022 alone EHOST will provide 137 million in property tax relief for those with homestead exemptions.

Administration Building 110 East Sycamore Street. DeKalb County Tax Commissioner Motor Vehicle Division PO. Property Tax DeKalb County Tax Commissioner Property Tax Division PO.

Burroughs graduated from Emory University School of Law in 1978 and was admitted to practice law in the State of Georgia the same year. A-Z Index Online Records Property Data and Maps Job Opportunities Calendar. Real Estate Property Tax Return.

Dekalb County Tax Commissioner S Office

Dekalb County Tax Commissioner S Office Dekalbtaxga Twitter

Contact Us Dekalb Tax Commissioner

Cobb County Tax Commissioner S Office Linkedin

Dekalb County Tax Commissioner S Office

220 N Hightower St Thomaston Ga 30286 Property Record

Property Tax Dekalb Tax Commissioner

Cobb County Tax Commissioner S Office Linkedin

Click2skip Dekalb Tax Commissioner

How To Find Tax Delinquent Properties In Your Area Rethority

Property Tax Dekalb Tax Commissioner

Dekalb County Tax Commissioner S Office

Dekalb County Tax Commissioner Reminds Property Owners Of First Installment Deadline Encourages Online Payment Before Sept 30 On Common Ground News 24 7 Local News

Redeem A Non Judicial Tax Deed Gomez Golomb Law Office

Dekalb County Property Tax Assessment Appeal Process Virtual Seminar Youtube